When you’re trading futures via a prop firm, one of the first things you notice is that the market never actually sleeps. Okay, the stock market may have that traditional 9:30 a.m. to 4:00 p.m. New York thing, but futures? They’re like that friend who’s always up no matter when you send them a text. And whereas that ubiquitous access is a dream come true, it has its own peculiarities—particularly when it involves volatility and prop firm rules.

Let’s walk through it and examine how various futures trading hours affect how you trade, what opportunities you perceive, and what rules you must abide when you’re trading a prop firm account.

Futures Trading Hours 101

The vast majority of futures contracts—whether we’re speaking of E-mini S&P 500, crude oil, or gold—trade virtually 24 hours a day, five days a week. The center of primary trading is the CME (Chicago Mercantile Exchange), and they’ve divided sessions up so that you see plenty of access:

- Globex session (overnight/electronic): This operates nearly around the clock, often from Sunday evening to Friday evening.

- Regular trading hours (RTH): These are the “official” times when the pit (when there was one) or the main session operates. For equity futures, that’s generally 9:30 a.m. to 4:00 p.m. ET, synchronizing with the stock market.

- Pre-market and post-market sessions: The less active periods pre- and post-RTH, when liquidity is apt to dry up.

Volatility Isn’t Always the Same

The fact that volatility fluctuates throughout the day is perhaps the most important realization for futures traders, and prop firm traders in particular. It comes in cycles instead.

- The open (9:30 a.m. ET for equity futures): It gets rowdy here. Overnight orders get matched, news from previous in the day hits, and liquidity comes in. Volatility typically peaks.

- Midday lull: By late morning to early afternoon, things tend to mellow out. Volume diminishes, spreads blow out, and price action can be sluggish.

- The close (approximately 4:00 p.m. ET): Energy again increases as rebalancing traders, settlement of positions by funds, and day traders close. Equity-related futures frequently experience another surge of volatility at this time.

- Overnight session: This varies with world markets. Asia’s open, for instance, can ruffle equity futures, while crude oil futures may perk up when Europe rises. But generally, overnight trading is lighter, and that reduced liquidity can translate into steeper, more volatile moves.

It is important to know these cycles because volatility controls risk, and risk is paramount in the world of prop firms.

Why Prop Firms Care About Futures Trading Hours

If you’ve ever joined an instant funding futures prop firm or any other prop shop, you’ll know they don’t just hand out capital and say, Go wild. They’ve got rules—and those rules often tie directly into market hours.

Here’s why:

Risk management

Prop firms prefer to be consistent. They understand that they are taking a double-edged sword in terms of profits and losses by trading at high-volatility periods such as the open or close. To safeguard their capital, firms may impose limitations on trading some contracts outside of normal hours or restrict overnight exposure.

Liquidity considerations

In thin sessions, spreads can become extremely wide. Prop firms do not want their traders blowing up on a position because liquidity disappeared at 3:00 a.m. They will impose rules that state no holding trades after a specified time, or no opening new positions during low-liquidity hours.

Evaluation challenges

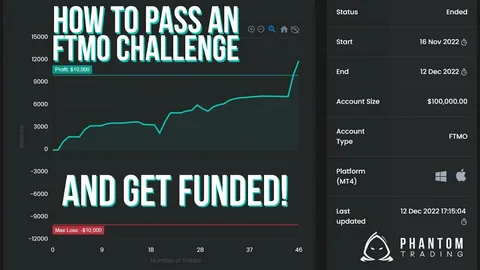

If you’re in a prop firm challenge, futures trading hours can make or break you. Some traders try to game the system by trading overnight when the market is quieter, but firms know the risks there. They might only evaluate your performance during regular trading hours or require a certain number of trades in high-volume sessions.

Overnight risk

Futures markets may gap wide when news breaks abroad. When you’re long the E-minis and Europe surprises with unexpected economic news, you may wake up to an awakened margin call. That’s why most firms will not permit traders to carry positions overnight.

The Open: Thrilling but Perilous

Let’s discuss the open, because that’s where most traders (prop or independent) get their adrenaline fix. At 9:30 a.m. ET, stock-related futures markets are like a firehose blowing full force. Liquidity is heavy, but so are the order flows.

This time is opportunity and risk for prop firm traders

- Opportunity: When you have a good plan, this is where you can catch good directional moves and make profits fast.

- Risk: The noise can stop you out before you’ve had time to blink. A single whipsaw candle can cause a daily loss limit.

Prop shops are aware of this, which is why some of them enforce rigorous stop-losses or impose daily drawdowns. They do not want to have a trader go all-in at the opening, expecting a payday, and blowing up an account.

Midday Grind: Lower Volatility, Lower Risk?

After the morning volatility has passed, the market tends to slide into that midday grind. This can be an excellent time for traders who like scalping or more sedate, range-bound approaches.

Prop firms usually don’t restrict trading during this period—it’s relatively safe—but here’s the catch: the lack of volatility can make it harder to hit profit targets. If you’re in a challenge with a 10-day evaluation period, for example, grinding out small gains during lunch hours might not cut it.

So, while risk is lower, so is opportunity. That’s a balance every funded trader has to think about.